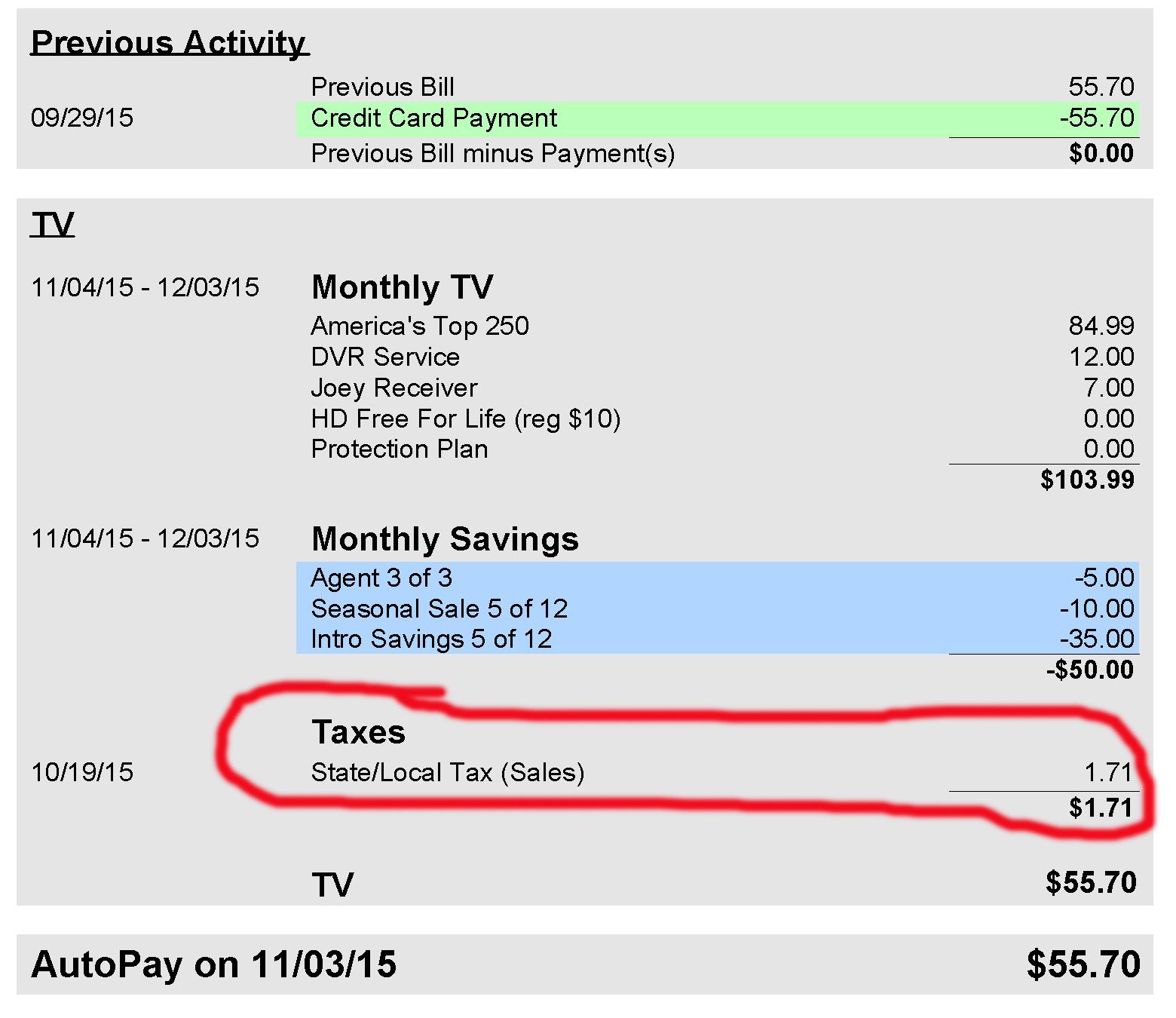

Anybody else live in Missouri? We have no satellite tax, but I'm being charged state/local sales taxes on my receivers (one of which I own). How can DISH charge tax every month on receivers I own? I already paid tax when I bought them. Just doesn't make sense to me.

Taxes

- Thread starter comfortably_numb

- Start date

- Latest activity Latest activity:

- Replies 43

- Views 4K

-

ENJOY SATELLITEGUYS AD FREE THIS FEBRUARY!

Thank you to the very generous support we got from our members in December we have decided to make the month of February AD FREE for everyone!

We want to see the true speed of our site and enjoy SatelliteGuys the way it was meant to be enjoyed!

If you would like to help us keep the lights on and keep enjoying the site AD FREE consider becoming a PUB MEMBER by CLICKING HERE.

THANK YOU TO EVERYONE FOR YOUR SUPPORT!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

J

JessicaR1

Guest

After review, it shows that Missouri has a 4.225% tax rate on leased and purchased equipment. This tax rate also applies to transaction fees, late fees, and the monthly guide (if subscribed).

How can you tax purchased equipment? Tax has already been paid. In effect, we are paying the tax over and over and over and over again.....

Jessica is unable to post links or emails for some reason but please visit mydish.com/support/taxes-charges for additional information regarding taxes and contact consumertaxissues@dish.com if you have any additional questions or concerns.

Jessica is unable to post links or emails for some reason but please visit mydish.com/support/taxes-charges for additional information regarding taxes and contact consumertaxissues@dish.com if you have any additional questions or concerns.

Zach, I read the link. The first bullet says "Sales Tax: These are taxes imposed on the purchase of goods and services. The applicable rate is set by each state." My receiver has already been purchased and tax has already been paid, so my question remains: how can you continue to tax an item for which tax has already been paid? I'm sure everyone else in this great state would like to know as well.

It's not just your state it's our state too, and probably every state. And personally I really don't care about the dollar something because there's nothing I can do about it other than vote for somebody who wants to lower taxes.

When I had Directv, we didn't pay tax on receiver fees (that I can recall). I thought that one of the "perks" of buying your own equipment was not having to pay tax on it over and over again. I realize it's not a lot of money ..

Perhaps it is the 'services' portion not the 'goods.'

Then, wouldn't that be where the satellite tax would come into play? (which this state doesn't have)

Then, wouldn't that be where the satellite tax would come into play? (which this state doesn't have)

Use tax is imposed on the storage, use or consumption of tangible personal property in this state.

LOL thats a gotya tax,Dish is doing you a service by collecting it for you

Use tax is imposed on the storage, use or consumption of tangible personal property in this state.

LOL thats a gotya tax,Dish is doing you a service by collecting it for you

I suppose I should pay tax to the state every time I turn on my television, too, then. And my computer. And my cell phone...

You best bet is to contact the email address I provided as CSRs (which DIRT members are) will not be familiar with tax laws and can only provide you the information we have available to us.Zach, I read the link. The first bullet says "Sales Tax: These are taxes imposed on the purchase of goods and services. The applicable rate is set by each state." My receiver has already been purchased and tax has already been paid, so my question remains: how can you continue to tax an item for which tax has already been paid? I'm sure everyone else in this great state would like to know as well.

Satellite tax sounds more like the satellite service, where the reciever tax would be for any active receiver. As JSheridan said, your only recourse is to elect someone who wants to lower taxes.Then, wouldn't that be where the satellite tax would come into play? (which this state doesn't have)

So, why does DISH collect it and DTV doesn't? (or at least they didn't used to). Anybody know? It just seems like something cooky is goin' on here, that's all!

You pay tax on everything you buy except for Food, Clothes,and for some reason Internet.

So I'm charged tax on my Programming and my monthly receiver fees.

There are at least three states that don't tax purchases. I live in one of them.It's not just your state it's our state too, and probably every state.

The odd part is that some states tax rentals or leases at a relatively high rate as compared with purchases. This is one of the very few reasons that owning equipment might make sense.

There are at least three states that don't tax purchases. I live in one of them.

The odd part is that some states tax rentals or leases at a relatively high rate as compared with purchases. This is one of the very few reasons that owning equipment might make sense.

In Missouri, apparently, they tax it regardless of whether you purchased it or you lease it. So, in effect, there is no advantage to buying a receiver for me, I guess.

They may. Who knows when the tax code changed or what it says specifically. Go to your local city hall and see if you can find the tax code.

It's a STATE tax. Not a local tax.

In Missouri, apparently, they tax it regardless of whether you purchased it or you lease it. So, in effect, there is no advantage to buying a receiver for me, I guess.

First off, I think it's pretty well known that the only advantages to owning equipment is.............first, you don't have to enter a contract when you buy your own equipment.............and second, you can turn service off and on without having to return equipment.

Secondly, I don't see how you can determine what they're taxing by your statement. I think you have to pay a receiver fee, even if you own your equipment. So, the tax wouldn't be on the sales of any equipment, but on the equipment fees themselves. In other words, they're not taxing your equipment, they're taxing the equipment fee. I'm just guessing, because $1.71 tax on $19.00 is 9% not 4.225%.

Users Who Are Viewing This Thread (Total: 0, Members: 0, Guests: 0)

Who Read This Thread (Total Members: 1)

Latest posts

-

LWorkout Headphones with ANC that Don’t Stick in your Ear - Shokz OpenFit Pro Showcase

- Latest: Linus Tech Tips

-

T

-

TApple's 30% Cut on Patreon Donations Made Through the Patreon iPhone App

- Latest: TWiT Tech Podcast Network

-