Stephenson: FCC's rules no longer holding back investment

May 18 2015, 10:22 ET | By: Jason Aycock, SA News Editor

After a pause, AT&T (T +0.4%) looks ready to move forward with new investment on the expectation that new net neutrality rules will get changed either by the courts (AT&T is party to action in federal court) or Congress.

CEO Randall Stephenson had suggested that the company pause a plan to spend billions while they awaited the final rules from the FCC on how the industry would be regulated.

Now: "So we've said we're going to invest around $18 billion this year. That will allow us to deploy a wireless broadband solution to 13 million homes around the U.S.," he said on CNBC. "That compares to about $22 billion last year."

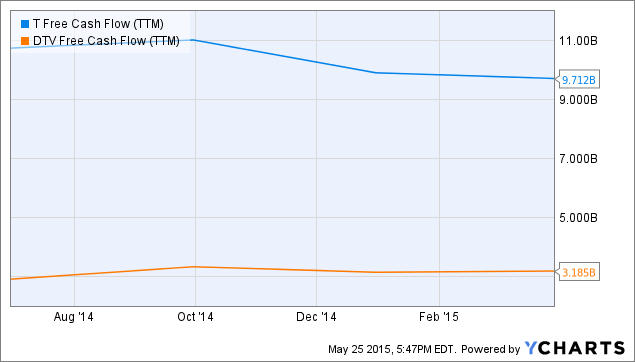

AT&T extended its deadline for acquiring DirecTV (NASDAQ TV) as it expects to close the deal in Q2 and many observers think the acquisition will be done at least by July.

TV) as it expects to close the deal in Q2 and many observers think the acquisition will be done at least by July.

http://seekingalpha.com/news/253003...h:7f3e45b9da01947f4b843c7e70501a7e#email_link

May 18 2015, 10:22 ET | By: Jason Aycock, SA News Editor

After a pause, AT&T (T +0.4%) looks ready to move forward with new investment on the expectation that new net neutrality rules will get changed either by the courts (AT&T is party to action in federal court) or Congress.

CEO Randall Stephenson had suggested that the company pause a plan to spend billions while they awaited the final rules from the FCC on how the industry would be regulated.

Now: "So we've said we're going to invest around $18 billion this year. That will allow us to deploy a wireless broadband solution to 13 million homes around the U.S.," he said on CNBC. "That compares to about $22 billion last year."

AT&T extended its deadline for acquiring DirecTV (NASDAQ

http://seekingalpha.com/news/253003...h:7f3e45b9da01947f4b843c7e70501a7e#email_link