Bruce

Bender and Chloe, the real Members of the Year

Original poster

Supporting Founder

Lifetime Supporter

- Nov 29, 2003

- 17,705

- 23,243

If things are this bad for Dish, imagine what they are like for DirecTV.

Charlie Ergen quietly flew to Dubai earlier this month to woo potential investors for his struggling satellite TV giant Dish, On The Money has learned.

The mercurial billionaire's fundraising attempt came just a week before Ergen admitted on Dish's May 3 earnings call that "the debt market is essentially closed."

Dish has seen its bonds trade for as little as 30 cents on the dollar as it faces $14.7 billion worth of distressed debt.

"They need a white knight to save them from their financial situation," one source to the matter told On The Money. "Otherwise they've got to be considering all options — including bankruptcy."

Dish (DISH) short interest is 20%.

nypost.com

nypost.com

seekingalpha.com

seekingalpha.com

Charlie Ergen quietly flew to Dubai earlier this month to woo potential investors for his struggling satellite TV giant Dish, On The Money has learned.

The mercurial billionaire's fundraising attempt came just a week before Ergen admitted on Dish's May 3 earnings call that "the debt market is essentially closed."

Dish has seen its bonds trade for as little as 30 cents on the dollar as it faces $14.7 billion worth of distressed debt.

"They need a white knight to save them from their financial situation," one source to the matter told On The Money. "Otherwise they've got to be considering all options — including bankruptcy."

Dish (DISH) short interest is 20%.

Dish’s Charlie Ergen flew to Dubai to fundraise for satellite TV giant, source says

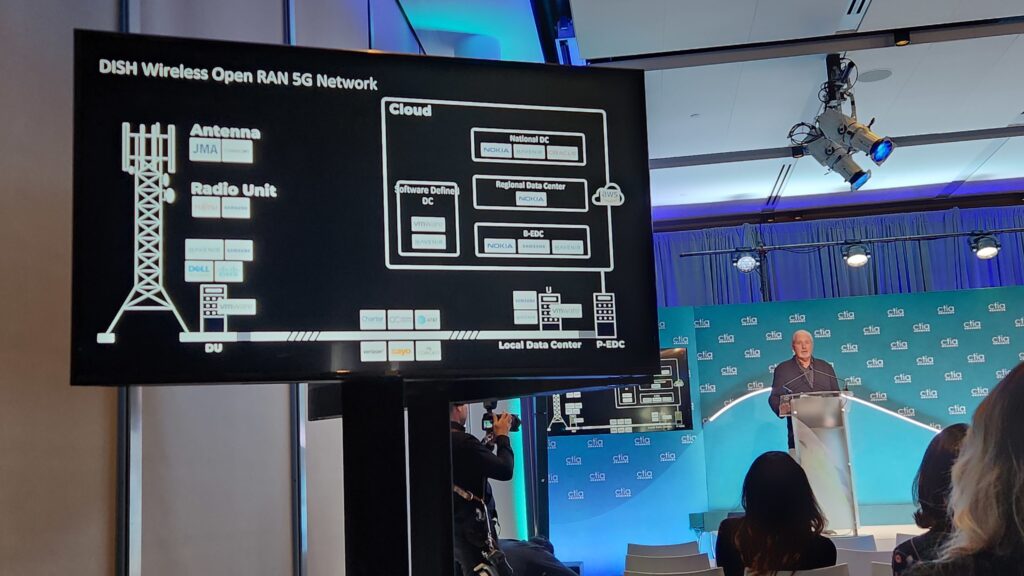

Dish has committed to build out a 5G wireless network that will serve 70% of the US by summer of 2023.

Dish Chairman Charlie Ergen recently flew to Dubai to try to get funding - report

Dish Chairman recently flew to Dubai to try to get funding from investors for his struggling satellite communications company, according to a NY Post report.Dish (DISH) need to raise...