Gas Price Info With National Gas Temperature Map

- Thread starter dfergie

- Start date

- Latest activity Latest activity:

- Replies 5K

- Views 454K

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

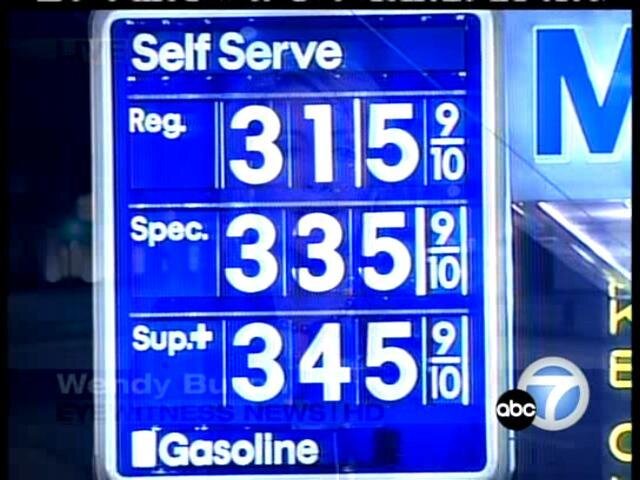

Hehehe, most people here crying about gas nearing 3 bucks how about 4 bones?

Just captured this on my WinTV-PVR-150 with local ABC channel.

First image from Beverly Hills, CA

Second image from Westwood, CA

Third image from Sherman Oaks, CA

Just captured this on my WinTV-PVR-150 with local ABC channel.

First image from Beverly Hills, CA

Second image from Westwood, CA

Third image from Sherman Oaks, CA

Attachments

Last edited:

I would NOT add acetone to car fuel. Use it for machine parts cleaning even in low concentrations it attacks rubber plastic and others, turns plastic to goo/

is saving a little on fuel worth replacing your fuel system?

is saving a little on fuel worth replacing your fuel system?

Bob Haller said:NOTE for anyone considering a hybrid!

The cost of the vehicle is so much more you will never recoop the money. let alone replacing the battery bank, if you keep the vehicle a long time

prius and others are a marketers dream touchey feel good but really just extra profilt for the company

At this point its more about principal and doing the right thing. The more hybrids get sold, the price should start to drop. At this point I would rather have Toyota get my money than Saudi Arabia or Exxon Mobil.

Heck, the car will more than break even if gas hits 4 bucks. Dont doubt that it will in the next year or so.

$2.75 (regular unleaded) this morning at Costco.

As painful as it is, I'll stick with my paid for SUV. I can buy a hell of a lot of gas for the price of a Prius, even at $3 a gallon. Besides I saw what happened to one when it tangled with a mid-sized SUV (Prius driver lost control on ice and crossed the center line). Score: Explorer - no injuries, Prius - 3 dead.

NightRyder

As painful as it is, I'll stick with my paid for SUV. I can buy a hell of a lot of gas for the price of a Prius, even at $3 a gallon. Besides I saw what happened to one when it tangled with a mid-sized SUV (Prius driver lost control on ice and crossed the center line). Score: Explorer - no injuries, Prius - 3 dead.

NightRyder

4/26/2006: $2.959 at the station on the corner.

Here's an interesting article at Autoweek about how various vehicles did on a Spring Beer Run. Looking at the prices they paid for gas ($2.599) on their drive, it must have been quite a few weeks ago.

Hint: The Prius didn't win.

NightRyder, true, the smaller vehicle lost, but in today's litigious society, what are the odds that the survivors get sued because they knowingly purchased a vehicle demonstrated to be dangerous to the smaller vehicles on the road?

Here's an interesting article at Autoweek about how various vehicles did on a Spring Beer Run. Looking at the prices they paid for gas ($2.599) on their drive, it must have been quite a few weeks ago.

Hint: The Prius didn't win.

NightRyder, true, the smaller vehicle lost, but in today's litigious society, what are the odds that the survivors get sued because they knowingly purchased a vehicle demonstrated to be dangerous to the smaller vehicles on the road?

Last edited:

$2.849 for the cheap stuff... Harrison AR

Kum & Go has taken out their mid and Hi-Test grades here in North Ark. Springfield MO had a Kum & Go yesterday with WATER in their storage tanks. Several vehicles had to be towed away from the pumps.

MurphyUSA(WallyMart) is $2.819

My '95 Dodge Intrepid gets better gas mileage on hi-test(91-92 octane) than it does on 87.

I've gotten 425 miles on 15 gallons(28mpg) hwy of 91-92 octane and 375 miles(25mpg) on 87. These were all highway road trip miles with no notable terrain differences or driving style.

In town, it goes way down... 21mpg

Kum & Go has taken out their mid and Hi-Test grades here in North Ark. Springfield MO had a Kum & Go yesterday with WATER in their storage tanks. Several vehicles had to be towed away from the pumps.

MurphyUSA(WallyMart) is $2.819

My '95 Dodge Intrepid gets better gas mileage on hi-test(91-92 octane) than it does on 87.

I've gotten 425 miles on 15 gallons(28mpg) hwy of 91-92 octane and 375 miles(25mpg) on 87. These were all highway road trip miles with no notable terrain differences or driving style.

In town, it goes way down... 21mpg

And now we hear that China is bidding for and will win drilling rights in the Gulf of Mexico (see foxnews.com John Gibsons My Word) and we are not involved in the bidding because of enviro concerns. Brillant!!!! Go to foxnews.com and read this. Very Alarming!

Probably posted earlier, but have you noticed that a barrel of oil has dropped $3.00 a barrel in the last few days, but (in the Greater Washington, DC area) gasoline prices have NOT changed!

Gee, no wonder Exxon/Mobil makes those astronomical profits!

Gee, no wonder Exxon/Mobil makes those astronomical profits!

animalhouse said:Probably posted earlier, but have you noticed that a barrel of oil has dropped $3.00 a barrel in the last few days, but (in the Greater Washington, DC area) gasoline prices have NOT changed!

Gee, no wonder Exxon/Mobil makes those astronomical profits!

Those oil prices reflect the date's spot market; not for oil or fuel already paid for in the storage facilities or down to the stations.

SPOT MARKET

Depending on the item being traded, spot prices can indicate market expectations of future price movements in different ways. For a security or non-perishable commodity (e.g. OIL), the spot price reflects market expectations of future price movements. In theory, the difference in spot and forward prices should be equal to the finance charges, plus any earnings due to the holder of the security, according to the cost of carry model. For example, on a share the difference in price between the spot and forward is usually accounted for almost entirely by any dividends payable in the period minus the interest payable on the purchase price. Any other price would yield an arbitrage opportunity and riskless profit.

http://en.wikipedia.org/wiki/Petroleum#Pricing

Similar threads

- Replies

- 1

- Views

- 1K

- Replies

- 19

- Views

- 2K

- Replies

- 11

- Views

- 978

- Replies

- 3

- Views

- 1K

Users Who Are Viewing This Thread (Total: 1, Members: 0, Guests: 1)

Who Read This Thread (Total Members: 149) Show all

- dfergie

- Bobby

- harshness

- waylew

- EatMyVolts

- b4pjoe

- RaiderPower

- NASCARfan18

- Mr Tony

- cpalmer2k

- osu1991

- worstman1

- meStevo

- Foxbat

- navychop

- Hyper Casey

- TRG

- reubenray

- WhiteBeard

- Tom Speer

- klang

- "MysteryMan"

- John2021

- norman881

- Lone Gunman

- Ronnie-

- mikew

- Redneck_Randy

- ClarkGable

- clucas

- Flippi

- Mr_Dc2tracker

- pamajestic

- BatStang2000

- NYDutch

- bcwmachine

- jimgoe

- sdfntx

- thomasjk

- jayn_j

- Yespage

- byron

- TazMan258

- phlatwound

- moonwink

- EENAU

- TheKrell

- herdfan

- dishdude

- yetimizer361

- Nexrad2

- MrMars

- nelson61

- GravelChan

- mdram

- FTA4PA

- cpdretired

- mackie99

- madmadworld

- VictoriaFTA

- ncted