Directv Posts Year End Results.

DIRECTV Q4 Free Cash Flow Increases 64% to a Record $710 Million

EL SEGUNDO, Calif., Feb 18, 2010 (BUSINESS WIRE) --

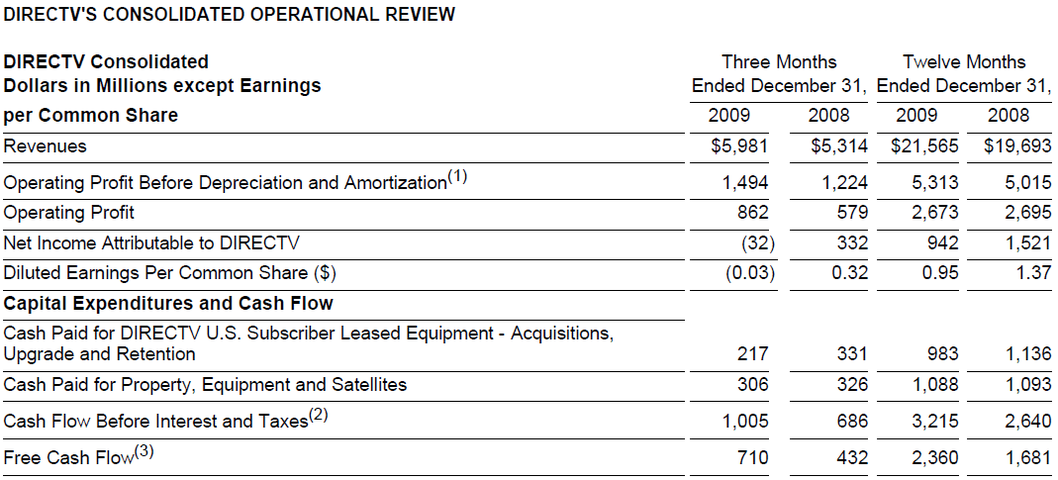

DIRECTV (NASDAQ TV) today reported that fourth quarter 2009 consolidated revenues increased 13% to $5.98 billion, operating profit before depreciation and amortization1 (OPBDA) increased 22% to $1.49 billion while operating profit increased 49% to $862 million compared to last year's fourth quarter. Fourth quarter net income attributable to DIRECTV declined to a loss of $32 million while earnings per share fell to a loss of $0.03 compared with the same period last year. Excluding a pre-tax charge of $491 million ($486 million after tax) related to the merger with Liberty Entertainment completed on November 19, 2009, net income attributable to DIRECTV and diluted earnings per share increased 37% to $454 million and 50% to $0.48, respectively, compared with the fourth quarter of last year.

TV) today reported that fourth quarter 2009 consolidated revenues increased 13% to $5.98 billion, operating profit before depreciation and amortization1 (OPBDA) increased 22% to $1.49 billion while operating profit increased 49% to $862 million compared to last year's fourth quarter. Fourth quarter net income attributable to DIRECTV declined to a loss of $32 million while earnings per share fell to a loss of $0.03 compared with the same period last year. Excluding a pre-tax charge of $491 million ($486 million after tax) related to the merger with Liberty Entertainment completed on November 19, 2009, net income attributable to DIRECTV and diluted earnings per share increased 37% to $454 million and 50% to $0.48, respectively, compared with the fourth quarter of last year.

"I am thrilled to be joining DIRECTV at a time when it has just completed one of its strongest years ever," said Mike White, president and CEO of DIRECTV. "Strong fourth quarter results capped a record-setting year for both our U.S. and Latin American businesses as DIRECTV became the world's largest provider of pay television services while also growing full year consolidated revenues by nearly 10% to $21.6 billion and free cash flow by over 40% to a record $2.4 billion. I'm also pleased to announce that our Board has approved a new share repurchase plan of $3.5 billion."

White continued, "In the U.S., DIRECTV had strong fourth quarter financial results as revenues grew 8% to $5.1 billion, OPBDA margin expanded 260 basis points contributing to OPBDA growth of 21% to $1.3 billion and cash flow before interest and taxes increased 42% to a record $989 million. The significant growth in margins was largely due to operational improvements achieved over the past year in most key areas of our business including attaining greater returns on our upgrade and retention costs through more disciplined cost management and better customer segmentation, as well as gaining significant advances in our customer service levels and efficiencies. Our 119,000 net subscriber additions and higher subscriber acquisition costs in the quarter reflect tighter credit policies, increased competition and a generally cautious consumer seeking value in what continues to be a sluggish economy."

White said, "In Latin America, increasing demand for DIRECTV's pre-paid, DVR and HD services in a relatively stable macro-economic environment drove record growth across the region. Propelled by strong results in Venezuela, Colombia and Brazil, DTVLA's gross additions grew 35% to 460,000 and net additions increased 59% to an all-time high of 254,000 in the fourth quarter. DTVLA revenues and OPBDA were also extremely strong in the quarter growing 47% and 20%, respectively, fueled by the significantly larger subscriber base and favorable exchange rates in Brazil.

"We head into 2010 with strong operating and financial momentum. In the U.S., we look to extend our video leadership with the introduction of many innovative and differentiated services including Multi-Room Viewing, 3-D, DIRECTV Cinema and the debut of our much-anticipated Home Media Center in the second half of this year." White added, "In Latin America, we're expecting another year of tremendous growth fueled by greater sales of our popular pre-paid services, increasing demand for HD and DVR services, as well as unparalleled coverage of the FIFA World Cup. With these strengths in both the U.S. and Latin America, we're targeting another strong year financially as DIRECTV again strives for industry-leading top-line and bottom-line growth rates."

DIRECTV Fourth Quarter Results Complete Another Record Setting Year for the Company

DIRECTV Q4 Free Cash Flow Increases 64% to a Record $710 Million

- Solid revenue growth, improved margins and lower capital expenditures at DIRECTV U.S. fuel full year DIRECTV free cash flow growth of 40% to a record $2.4 billion

- Four-year high net subscriber additions at DIRECTV U.S. of 939,000 and record full year net additions at DIRECTV Latin America of 692,000 propel DIRECTV revenue growth of 10% to $21.6 billion in 2009

- DIRECTV U.S. Q4 margin expansion of 260 basis points to 25% contributes to full year DIRECTV U.S. Operating Profit before Depreciation and Amortization growth of 7% to $4.7 billion

EL SEGUNDO, Calif., Feb 18, 2010 (BUSINESS WIRE) --

DIRECTV (NASDAQ

"I am thrilled to be joining DIRECTV at a time when it has just completed one of its strongest years ever," said Mike White, president and CEO of DIRECTV. "Strong fourth quarter results capped a record-setting year for both our U.S. and Latin American businesses as DIRECTV became the world's largest provider of pay television services while also growing full year consolidated revenues by nearly 10% to $21.6 billion and free cash flow by over 40% to a record $2.4 billion. I'm also pleased to announce that our Board has approved a new share repurchase plan of $3.5 billion."

White continued, "In the U.S., DIRECTV had strong fourth quarter financial results as revenues grew 8% to $5.1 billion, OPBDA margin expanded 260 basis points contributing to OPBDA growth of 21% to $1.3 billion and cash flow before interest and taxes increased 42% to a record $989 million. The significant growth in margins was largely due to operational improvements achieved over the past year in most key areas of our business including attaining greater returns on our upgrade and retention costs through more disciplined cost management and better customer segmentation, as well as gaining significant advances in our customer service levels and efficiencies. Our 119,000 net subscriber additions and higher subscriber acquisition costs in the quarter reflect tighter credit policies, increased competition and a generally cautious consumer seeking value in what continues to be a sluggish economy."

White said, "In Latin America, increasing demand for DIRECTV's pre-paid, DVR and HD services in a relatively stable macro-economic environment drove record growth across the region. Propelled by strong results in Venezuela, Colombia and Brazil, DTVLA's gross additions grew 35% to 460,000 and net additions increased 59% to an all-time high of 254,000 in the fourth quarter. DTVLA revenues and OPBDA were also extremely strong in the quarter growing 47% and 20%, respectively, fueled by the significantly larger subscriber base and favorable exchange rates in Brazil.

"We head into 2010 with strong operating and financial momentum. In the U.S., we look to extend our video leadership with the introduction of many innovative and differentiated services including Multi-Room Viewing, 3-D, DIRECTV Cinema and the debut of our much-anticipated Home Media Center in the second half of this year." White added, "In Latin America, we're expecting another year of tremendous growth fueled by greater sales of our popular pre-paid services, increasing demand for HD and DVR services, as well as unparalleled coverage of the FIFA World Cup. With these strengths in both the U.S. and Latin America, we're targeting another strong year financially as DIRECTV again strives for industry-leading top-line and bottom-line growth rates."