There are only two groups of people who care about the subscriber count, up or down by a measily 29,000. Those who work in subscriptions at Dish Network and DirecTV and the zealots who hate dish Network who hang around these threads in the forums.

Several posts here are worried for investors in Dish stock. As an investor in Dish Network, I am only concerned about profits! I also recognize that the first subscribers to jump ship are those who are likely low profitable customers and not good revenue sources for the long haul. Many, like brother bob had Dish for a short while and then churned again. The moment D* ticks his button, Bob will again churn to something else. As a businessman I view his kind of account a liability until the second or third year. The real losses I see are those loyal customers, ( like me) who have reduced their account services to save a buck. I suspect these are much higher figures and unknown to us. So, I could be wrong, especially in light of the profitability which is the more important number to investors as that is a direct measurement of the management quality. When Bob or others call Dish and Charlie a bunch of bafoons, I see it as how they view how much they can get for free or have to pay. I'll call Charlie a bafoon when they report serious losses quarter after quarter. Until then, in my book, Charlie and company are great!

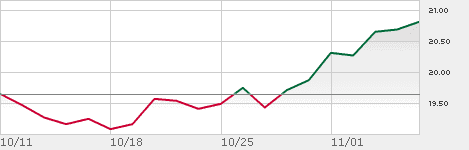

Normally a stock will soar up in anticipation of a good qtr report and then fall after the report. Dish continued to go up as the future is perceived as good for investors.

Personally, Dish was a disappointing year for me as an investor as the stock lollygaged around the $20 mark all year. DirecTV was a much better year as DTV went up almost 90%. There are all sorts of reasons for this that have more to do with stock price manipulation than actual product offerings such as the notion that DTV is moving back to private ownership which will increase the price of the stock with more buyers than sellers. But Dish did bring us a $2 per share one time dividend last December. A year ago the outlook for Dish Stock was $32 a share. This year it is only $24. Of more importance to me as an investor is the impact IPTV will have on MSO's in general. As these new services such as Netflix and Hulu+ come on board in 2011, we could see a significant negative impact in the stock of both D* and E*. If sat companies aren't careful they could be seeing the general business model decline we have with broadcast tv stations.

Several posts here are worried for investors in Dish stock. As an investor in Dish Network, I am only concerned about profits! I also recognize that the first subscribers to jump ship are those who are likely low profitable customers and not good revenue sources for the long haul. Many, like brother bob had Dish for a short while and then churned again. The moment D* ticks his button, Bob will again churn to something else. As a businessman I view his kind of account a liability until the second or third year. The real losses I see are those loyal customers, ( like me) who have reduced their account services to save a buck. I suspect these are much higher figures and unknown to us. So, I could be wrong, especially in light of the profitability which is the more important number to investors as that is a direct measurement of the management quality. When Bob or others call Dish and Charlie a bunch of bafoons, I see it as how they view how much they can get for free or have to pay. I'll call Charlie a bafoon when they report serious losses quarter after quarter. Until then, in my book, Charlie and company are great!

Normally a stock will soar up in anticipation of a good qtr report and then fall after the report. Dish continued to go up as the future is perceived as good for investors.

Personally, Dish was a disappointing year for me as an investor as the stock lollygaged around the $20 mark all year. DirecTV was a much better year as DTV went up almost 90%. There are all sorts of reasons for this that have more to do with stock price manipulation than actual product offerings such as the notion that DTV is moving back to private ownership which will increase the price of the stock with more buyers than sellers. But Dish did bring us a $2 per share one time dividend last December. A year ago the outlook for Dish Stock was $32 a share. This year it is only $24. Of more importance to me as an investor is the impact IPTV will have on MSO's in general. As these new services such as Netflix and Hulu+ come on board in 2011, we could see a significant negative impact in the stock of both D* and E*. If sat companies aren't careful they could be seeing the general business model decline we have with broadcast tv stations.